Plan Scenarios

William and Jerry share ownership (50/50) of ABC Corporation. William is 52 years old and has an annual compensation of $280,000. So does his partner Jerry, who is a few years younger than him at age 49. Samantha, the company’s salesperson, is age 45 and earns $150,000 per year. William, Jerry, and Samantha are the only Highly Compensated Employees in the company. The other two employees, who are Non-Highly Compensated, are Anne and Jim. Anne is age 40 and has an annual income of $100,000 and Jim is age 26 and earns $50,000 per year. William and Jerry would both like to implement a Retirement Plan for ABC Corp. that will allow them to maximize their annual benefits while contributing as little as possible to their current employees.

Below we will display a number of possible setups for ABC Corp. and describe why they would be more interested in one plan design over another. Everybody’s Age and Compensation will be the same for all scenarios, but sometimes their desired contributions and objectives will change so as to highlight the strengths and weaknesses of the plan being presented.

Notice- as of November 13, 2018, this page is being updated.

The images represent 2017 Tax Year, the text numbers represent 2019 Tax Year. Soon they will both be for 2019. Only the numbers change, the scenarios are effectively the same.

Defined Contribution

Neither William nor Jerry are interested in saving more than $60,000 each year.

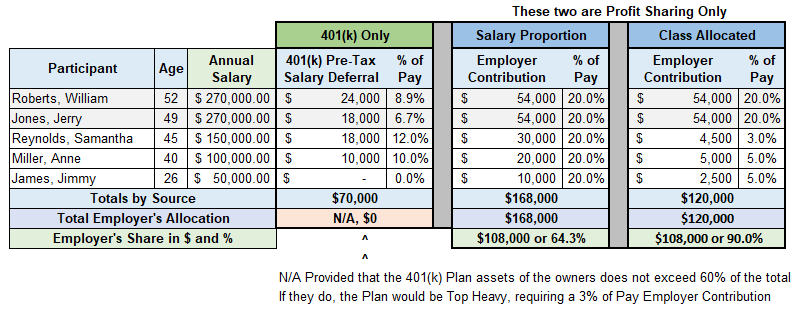

Illustrated below are three (3) different Defined Contribution Plans designed to maximize the owners’ benefit while minimizing their cost for employees. A 401(k) only plan is shown next to two Profit Sharing plans, the first being a uniform allocation based on salary, and the second being a New Comparability tiered allocation using custom-designed “classes” based on job descriptions to have different levels of allocation.

The key distinction about Profit Sharing is that it is Employers’ money. 401(k) is deducted from an individual’s gross paycheck each period and is totally voluntary. In this case, William and Jerry, the owners of an S-Corporation, would deduct their 401(k) from their declared earnings on the W-2. This deduction can be set up to be made as a % of each paycheck and automated through a payroll company. However, Jerry could only defer up to $19,000, and William up to $25,000 (because he is over age 49), which is far below what they would have liked to save in a tax-advantaged plan. Samantha couldn’t defer more than $19,000 either because she is younger than 50. In a 401(k) Plan, these are the hard limits.

The Profit Sharing options allow William and Jerry to contribute $56,000 each (William $62k) – a much higher sum, but also obligate them to pay their employees in Profit Sharing Contributions as well. The Salary Proportion design is self-describing: a set % of salary. This means that for William and Jerry to maximize their contribution, which is 20% of $280,000, they must also pay their employees 20%. To save money on employees’ pension expense, they would most likely prefer the Class Allocated design.

With a Class Allocated plan you can have as many tiers as you want. ABC Corp. in this example has 3 tiers, 20%, 5%, and 3%. If Jerry decides that he no longer wants to contribute any more money into his Profit Sharing plan, we could split the owners into 2 separate classes so that William can put away his 20% and Jerry can opt out. Classes are very flexible. However, William could never set everybody else’s rate to 0% while giving himself 20% because the Plan would fail discrimination testing. That is why a number of employees must get something – and the Class Allocated design above resembles the least ABC Corp. has to give away to still maximize William and Jerry. It’s a great example of the cost savings you can have over the Salary Proportion setup.

One of the more common issues with Profit Sharing plans relative to other pension plans is compliance with non-discrimination rules set by the DOL’s ERISA and enforced by the IRS. The Class Allocated design shown above is perfectly compliant, but future changes in employment such as the termination of a key employee or two may skew the ratios such that changes in the formula may be warranted. It’s actually fairly rare that we have to do this, but the bottom line is that it’s possible and your employees’ pension cost is not entirely predictable.

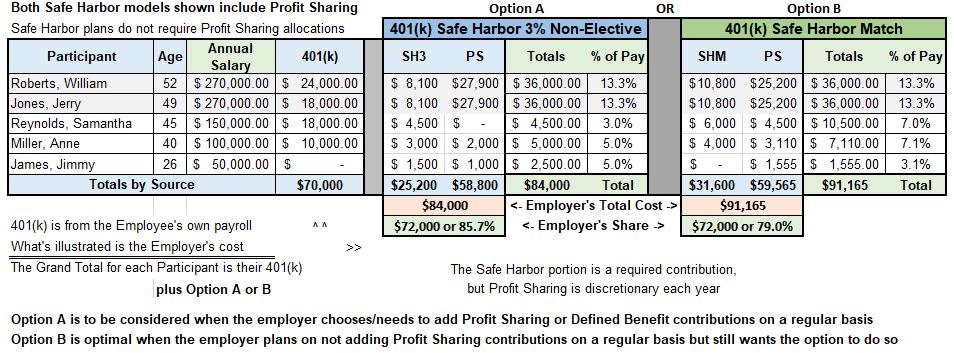

For this reason, we put forward some Safe Harbor designs. Any plan with a Safe Harbor will waive discrimination testing without constraining either your 401(k) or Profit Sharing contributions. Below you will see the original 401(k) on the left, which is to be added to one of the two Safe Harbor designs.

Bear in mind that while Safe Harbor and Profit Sharing are both Employers’ money, Safe Harbor contributions are mandatory whereas Profit Sharing is discretionary. Another difference is that Safe Harbor contributions are immediately 100% vested, meaning that they belong to the Employee. This is unlike a Profit Sharing contribution, in which the Employee’s vesting (their share of ownership) can be designed to steadily rise such that it can take up to 6 years at the company for them to own 100% of the Profit Sharing contributions made to them. This adds a level of complexity to the administration of your plan, but protects you from the risk of giving away money to “job hoppers” by allowing you to claw back the portion of the total balance (Forfeitures of Unvested moneys) that you already contributed but that they did not “earn” through sufficient years of service.

The distinction between Safe Harbor Non-Elective and Safe Harbor Match is that the first is money you must give indiscriminately in order to satisfy the waiver of discrimination testing while the latter achieves the same objective but is contributed as money “matched” to a participant’s 401(k) deferral. This is supposed to encourage employees to participate through 401(k) deferrals, but if they still do not do so then you won’t have anything to match. Though the calculation becomes a bit more complicated with the inclusion of Profit Sharing, the rule of thumb is that if you have relatively few employees that contribute 401(k), a Safe Harbor Match would be cheaper than a Safe Harbor Non-Elective. ABC Corp is a small company and so is not a great example, but this effect becomes very obvious with more employees.

In either case, a Profit Sharing component is necessary to reach the maximum deduction for Defined Contribution plans. That limit would be $62,000 for William and $56,000 for Jerry, the difference being explained by the age bonus (the “Catch-Up Contribution”) William gets for being over 49. A Safe Harbor Plan without Profit Sharing is also possible for those who would like to defer more than the 401(k) minimum but aren’t necessarily interested in maxing out either.

Defined Benefit

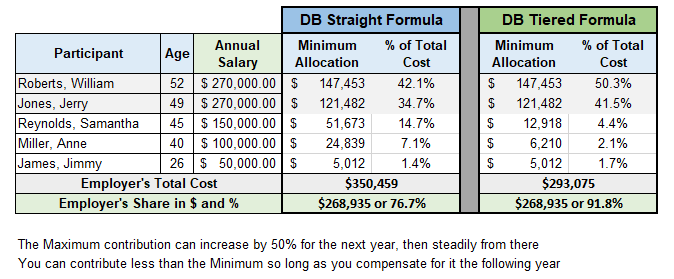

In these next scenarios William and Jerry now have a budget of $300,000. Defined Benefit Plans are attractive because they provide a significantly larger benefit than that from a Defined Contribution Plan. To understand the difference between Defined Contribution and Defined Benefit Plans please see our other page on Plan Descriptions.

Below are the two most basic forms of a Defined Benefit plan showing the minimum that must be contributed to achieve a sum of $2,600,000 by age 62. Note that this is effectively both an early retirement and super-sized benefit, and so resembles something of an optimistic plan.

With a straight formula allocation, all employees share the same benefit allocation rate projected until normal retirement age (NRA). An older participant would require a higher cost due to a shorter time frame until NRA. The Straight formula would be appealing to Sole-Proprietors because they don’t have any employee costs. Even in ABC Corp, a company with 3 employees, the Straight formula would cost almost $60,000 more each year for no benefit to William or Jerry. This is why the Tiered formula is widely preferred among those that want a basic Defined Benefit Plan.

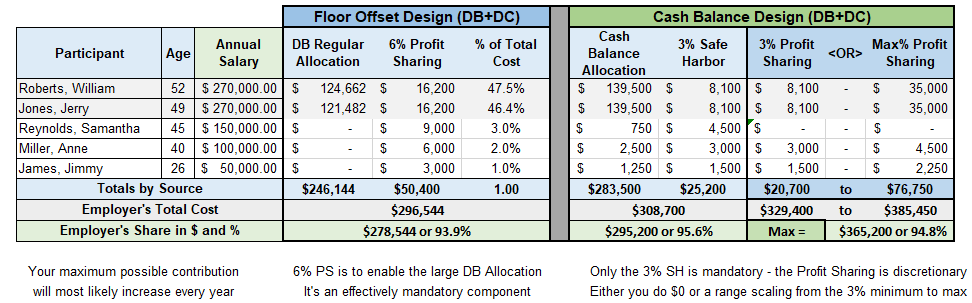

Below are some more interesting variants – the Floor Offset and the Cash Balance. For ABC Corp, these next two designs offer a higher maximum contribution for William and Jerry, but this is not necessarily true for all companies and you should check to see which design is best for you.

A Floor Offset Plan can lower contributions under the Defined Benefit Plan while allocating an employer contribution of 5% to 7.5% under a Defined Contribution Plan. This range is typically comprised of a 3% Safe Harbor Non-elective allocation with the rest Profit Sharing, but a 6% Profit Sharing is common enough that we have shown it above for simplicity. With this it is usually not necessary to provide a Defined Benefit contribution to the staff members in the Floor Offset Plan because they are already receiving a benefit under the Defined Contribution Plan. Based on the scenario in the chart above, the owners are receiving 93.9% of the total contribution and are benefiting from a much higher employer deduction.

A Cash Balance Plan allows the owners to receive similar benefits, subject to Defined Benefit limitations, but are tested and allocated in a way similar to that of a Profit Sharing Plan. The two are similar in operations and results, but it is easier for employees to understand their retirement benefit under a Cash Balance Plan as it better resembles the account design of a Defined Contribution Plan. See our other page on Plan Descriptions for more information on Cash Balance Plans.

While Cash Balance Plans can be an interesting choice with many advantages and appealing features, they do have one disadvantage; all plan documents must be prepared and submitted individually to the IRS for approval, which can be costly for the client. LAR Pensions, LLC will happily prepare free analysis and illustrations for clients of CPAs and Financial Advisors.

![]()