Plan Types

We offer all design, document and administrative services for the following types of retirement plans.

| 401(k) | A 401k is an employer sponsored plan which permits employees to contribute a flat dollar amount or percent of their compensation on a pre-tax or after tax (Roth) basis. |

| Profit Sharing | A profit-sharing plan is a defined contribution plan in which the employer has discretion to determine when and how much the company contributes into the plan. |

| New Comparability Cross-Tested | A new comparability plan (class allocated) is an entirely different type of Profit Sharing Plan that allows very substantial contributions for a selected group, with much lower contributions for the other employees, subject to IRS/ERISA non-discriminatory standards. |

| Defined Benefit | In a Defined Benefit Plan the contribution is calculated based on a desired benefit at retirement. Contributions are typically greater than any Defined Contribution type (401k/Safe Harbor/Profit Sharing) and are not limited to the 25% of total gross compensation limit of a defined contribution plans. There are many ways to design a Defined Benefit plan. |

| Defined Benefit(Tiered/Class Allocated) | This type of Defined Benefit Plan allows for different formulas within different job classes. Its purpose is to save a significant amount in funding costs. |

| Defined Benefit (Cash Balance) | This type of Defined Benefit Plan is also known as a Hybrid for its similarity to a Defined Contribution plan. It is intended for businesses whose owners/partners are of different age and the same cost is required. Also employees can understand the way benefits are prepared easier. |

401(k) Plans:

A 401K Plan is an employer sponsored plan which permits employees to contribution a flat dollar amount or percent of their compensation on a pre-tax or after tax (Roth) basis.

Individual record keeping accounts are maintained for participants, and participants may be given the option to “direct” the investments in their accounts among alternative investment funds offered through the plan. An employer contribution commitment may be needed to satisfy discrimination testing and/or top heavy requirements, expressed in a number of alternative ways. Basically, a 401(k) plan is an employee driven plan, where key employees and owners are affected by the actual participation levels of non-highly compensated employees. Adding a safe harbor feature to a 401(k) Plan waives all discrimination testing issues making it easier for the employer and key participants to defer the maximum. The annual 401(k) deferral limit for the 2021 plan year is $19,500 or $26,000 if 50 or older. A participant may want to consider having their deferrals made on an after tax basis, otherwise known as a Roth 401(k) deferral.

Advantages:

- 401(k) pre-tax contributions reduce the amount of taxes withdrawn from a participant’s paycheck.

- All pre-tax contributions and applicable earnings are tax-free until withdrawn from the Plan.

- Employees have the option to direct their own investments allowing them to control their savings.

- While a 401(k) is similar in nature to an IRA, an IRA does not offer the benefit of a company matching contributions and is subject to much lower limits.

- Payroll deductions. Most companies will have 401k contributions taken out automatically as a payroll deduction. Quarterly reports are also available from the investment company.

Disadvantages:

- Contributions are to be deposited within 7 business days after the end of each payroll period.

- Contributions are tested for discrimination purposes which may enforce withdrawals or un-anticipated employer contributions.

Profit Sharing

A profit-sharing plan is a defined contribution plan in which the employer has discretion to determine when and how much the company contributes into the plan.

The amount allocated to each individual account is usually based on the salary level of the participant (employee). The contributions accumulate tax-deferred and become taxable to the employee when distributed, either at retirement or upon the occurrence of a particular event, such as death, disability, severance of employment, etc.

Advantages:

- The contribution is a discretionary employer contribution. It is not mandatory and therefore the decision to make the contribution is done from year to year.

- Helps retain employees by providing them a benefit.

- The plan assets may be held in one pooled account, making it less expensive and easier to handle than other Plans.

- Such plans can be used in conjunction with a 401(k) plan or Defined Benefit Plans to maximize the benefits for the owners.

- Employer may provide a higher benefit to a certain class or department based on the allocation noted under the Plan.

- A vesting schedule applies which allows a participant to receive a pro-rated share of their benefit

upon termination of employment. The unvested portion of their benefit, also known as forfeitures, can then be used to reduce future contributions. - Administration is performed once per year, including distributions to terminated participants.

Disadvantages:

- Reduces employers working cash flow.

- Annual discrimination and top-heavy testing is required

- Alike all Pension Plans documentation and compliance with IRS, DOL and ERISA laws is required

| Special Considerations | |

| Maximum annual deduction: | Up to 25% of covered payroll may be contributed and deducted by the employer. Yet, you can allocate up to 100% of pay to a single participant as long as discrimination testing passes. |

| Compensation Base: | Plan allocations could vary in percentage of pay across the board, allowing those closer to retirement age to get up to 100% of their pay as their allocation. Employer Contributions: The employer defines the contribution amount each year. |

| Individual Limits: | The allocation of contributions to a participant’s account may not exceed the lesser of 100% of compensation or $58,000 per year (2021 limit). Age 50+ can do an extra $6,500. |

Maximum annual deduction:

Up to 25% of covered payroll may be contributed and deducted by the employer. Yet, you can allocate up to 100% of pay to a single participant as long as discrimination testing passes.

Compensation Base:

Plan allocations could vary in percentage of pay across the board, allowing those closer to retirement age to get up to 100% of their pay as their allocation. Employer Contributions: The employer defines the contribution amount each year.

Individual Limits:

The allocation of contributions to a participant’s account may not exceed the lesser of 100% of compensation or $58,000 per year (2021 limit). Age 50+ can do an extra $6,500.

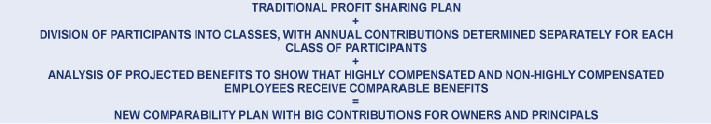

New Comparability/Cross-tested

A new comparability plan (class allocated) is an entirely different type of Profit Sharing Plan that allows very substantial contributions for a selected group, with much lower contributions for the other employees,subject to IRS / ERISA non-discriminatory standards. In some cases, annual contributions can be as high as 100% of pay or $58,000 per participant for a “highly compensated” group of employees. It is also permissible to have the “non-highly compensated” participants receive 5% of compensation or at least a 1/3 in proportion to the highest paid class. For example, if an owner is receiving 13.8% of pay then the allocation given to the non-highly compensated employees can be as little as 1/3 of that, which is only 4.6% of pay.

New comparability plans are ideal for businesses with owners and principals who:

- are older, on average, than their other employees (and the bigger the age spread the better)

- want the contribution flexibility of a profit sharing plan

- want the highest possible share of the plan contribution allocated on their behalf

![]()

How is all of this Possible?

IRS regulations allow employers to divide plan participants into two or more “classes,” and to make much larger contributions to the plan for one class than for another. Plan(s) is tested for discrimination at normal retirement date (age 65) rather than at present. Therefore, employees with more years until retirement can accrue an equivalent benefit to an older owner receiving a larger contribution. What is larger at retirement, a $1,000 contribution to a 50 year old or to a 28 year old?

What’s the bottom Line for Many Employees with this Plan?

The percentage of the plan contribution going to the accounts of owners and other highly compensated employees can be much higher with a new comparability plan than with a traditional profit sharing plan. And the cost of providing benefits to other employees can be remarkably low. See Plan Scenarios section

Defined Benefit

In a Defined Benefit Plan the contribution is calculated based on a desired benefit at retirement. Contributions are typically greater than $58,000 and are not limited to the 25% of total gross pay limit of a defined contribution plans. There are many ways to design a Defined Benefit plan. Defined Benefit plans are funded using actuarial calculations that factor in mandated or prudent assumptions for life expectancy, salary increases, rate of investment returns, cost-of-living adjustments, plan expenses, etc. The concept of account balances is absent in a traditional defined benefit pension plan. The participant’s present value of accrued benefits in a defined benefit pension plan replaces the concept of the account balance.

Advantages:

- A defined benefit pension plan provides security to the employee, because accrued benefits may not be reduced or eliminated and are definitely determinable as the name of the plan suggests

- A defined benefit pension plan can use a formula that is integrated with Social Security benefits, and provides higher benefits on compensation in excess of the taxable wage base

- With changes in the law stemming from EGTRRA 2001, an employer can adopt a deferral-only 401(k) plan in addition to a defined benefit pension plan. This allows employees to receive enhanced benefits. The employer can deduct contributions to both plans

Disadvantages:

- The employer’s funding obligation to a defined benefit pension plan is not discretionary or optional. The only flexibility is to contribute a minimum required contribution if the company is experiencing a lean year.

- In-service withdrawals are not allowed for employees under the Age of 62.

Defined Benefit (Tiered/ Class Allocated)

This type of Defined Benefit Plan allows for different formulas within different job classes. Its purpose is to save a significant amount in funding costs.

Different formulas are provided to different participants as determined by their job description / titles. These plans are mainly subject to the General test and Minimum coverage. The General test or Internal Revenue Code 401(a)(4) test determines how many Non-Highly compensated employees are required to receive similar benefits in comparison to those who are Highly compensated employees/owners thus, allowing for different formulations by class.

Advantages:

- Provides an opportunity for the Employer to lower their cost of employee benefits significantly

- These are considerable savings compared to a plain formula DB Plan

- One plan instead of two

Disadvantages:

- Testing issues may arise on companies with high employee turnover

- Requires contributions each year

Defined Benefit (Cash Balance)

This type of Defined Benefit Plan is also known as a Hybrid for its similarity to a Defined Contribution plan. It is intended for businesses whose owners/partners are of different age and the same cost is required. Also employees can understand the way benefits are prepared easier.

A cash balance plan is a type of defined benefit pension plan that possesses certain characteristics of a defined contribution plan. Mandatory contributions are made to employees’ hypothetical accounts based on any number of objective factors defined in the plan document such as compensation, age, and length of service. Earnings are usually based on an external index and are credited to employees’ theoretical accounts.

Advantages:

- These plans carry the potentially higher deduction limits of defined benefit pension plans

- Older, higher paid employees may receive higher benefits than in a defined contribution plan

- This type of plan is easier for the typical employee (and employer) to understand than a traditional defined benefit pension plan

- Cash balance plans are ideal for companies with multiple owners of different ages requiring the same benefit.

Disadvantages:

- All plan documents must be prepared and submitted individually to the IRS for approval

- Like a traditional defined benefit plan, the employer bears the downside risk of investment loss.